While some might think that dump trailer insurance is an unnecessary expense, it's actually a critical step in protecting their hefty investment.

It's not enough to just purchase any policy, though. The owner's specific needs, the type of trailer, and its intended use all play pivotal roles in determining the appropriate coverage.

There's so much more to explore about these key considerations — from understanding the fine print of policies to the types of coverage available.

Stay tuned to learn how to make an informed decision that could save thousands down the line.

Key Takeaways

- Dump trailer insurance offers specialized coverage for accidents, theft, and damage not typically covered by standard vehicle insurance.

- Evaluating potential risks like transportation accidents, weather incidents, and vandalism is crucial to understanding coverage needs.

- Understanding insurance policy terms such as coverage limits, exclusions, and deductibles is vital to select the right policy.

- Choosing a policy that aligns with the dump trailer's use, value, and inherent risks ensures optimal protection of your investment.

Understanding Dump Trailer Insurance

Understanding dump trailer insurance is important as it provides essential coverage in emergencies and unexpected damages, filling in gaps that regular vehicle insurance policies may not cover. This specialized insurance is specifically designed to shield owners from any damage caused to their trailers by unforeseen events.

It's critical to contemplate the limitations of standard vehicle insurance, which typically doesn't cover dump trailer damage or contents. This is where trailer insurance steps in, offering a safety net for those unexpected incidents that can cause serious financial strain.

An unfortunate reality is that liability coverage may not apply if a dump trailer becomes unhitched during transport. This is a common scenario that underscores the necessity of having a separate dump trailer insurance policy.

Having a thorough insurance coverage for your dump trailer not only provides peace of mind but also ensures you're prepared for any eventuality. By understanding the unique needs and risks associated with dump trailers, one can secure the right insurance to protect their investment.

Evaluating Potential Risks

While it's important to have insurance coverage for your dump trailer, it's equally fundamental to evaluate the potential risks that come with owning and operating these vehicles. An insurance agent can provide expert advice tailored to your specific needs, but understanding these risks can help inform your discussions and decisions regarding your vehicle insurance policy.

Potential risks include:

- Accidents during transportation or while loading/unloading: These can lead to significant property damage or bodily injury, requiring a robust liability insurance policy.

- Weather-related incidents: Severe weather can cause damage to the trailer or its contents.

- Theft: Dump trailers can be attractive targets for thieves due to their value.

- Vandalism: Malicious damage can lead to costly repairs or replacements.

- Damage to the trailer or its contents: This can happen in transit or while the trailer is stationary.

Types of Coverage Available

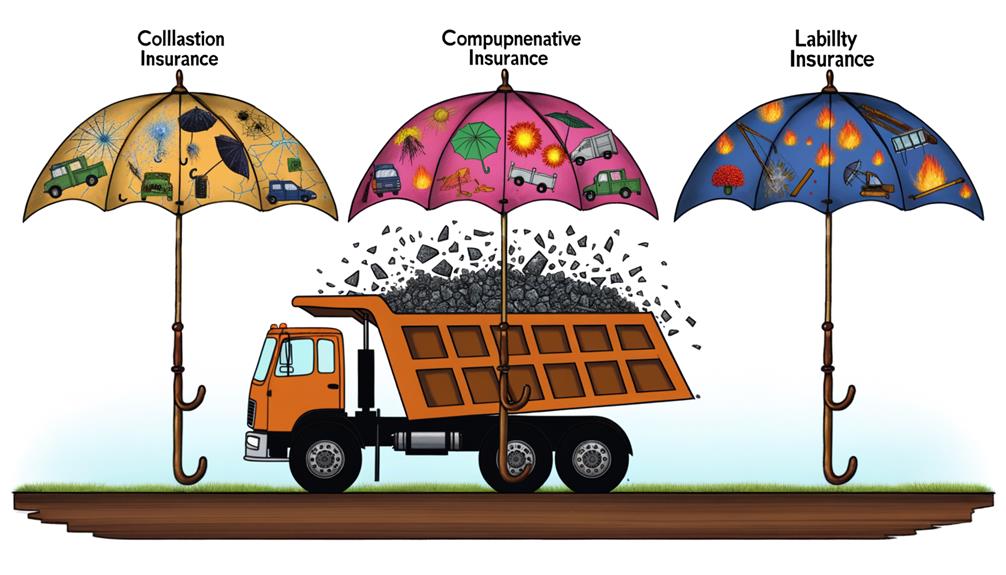

When it comes to insuring your dump trailer, several types of coverage are available to ponder, each offering a different level of protection against various risks. It's important to understand that not all policies are created equal, and the type of coverage needed will depend on individual circumstances.

The most basic level of coverage is liability insurance. This protects you if you're at fault for damages or injuries to another driver while using your dump trailer. Many people believe their personal auto policy will cover their dump trailer, but this isn't always the case. It's essential to verify these details with an insurance agent.

If your trailer is damaged in an accident, collision insurance can help cover the costs of repair or replacement. This type of policy is particularly important for commercial dump trailers, which often carry more significant financial risks.

Extensive insurance is another type of coverage available. This shields you from costs associated with non-collision incidents such as theft, vandalism, or natural disasters.

Understanding the types of coverage available is the first step in ensuring your dump trailer is adequately protected. Always consult with an insurance agent to determine the coverage you need.

Decoding Insurance Policy Terms

To fully benefit from your dump trailer insurance, it's important to decode the various policy terms, including coverage limits, exclusions, and the specific conditions or endorsements that could impact your claim process. A thorough understanding of these terms won't only provide peace of mind but also make sure you're adequately protected.

Consider the following key terms:

- Coverage limits: This is the maximum amount your insurer will pay for a covered loss. Knowing this limit can help you plan for any out-of-pocket expenses.

- Exclusions: These are specific conditions or situations that your truck insurance policy won't cover. Understanding these exclusions prevents unpleasant surprises when filing a claim.

- Deductible: This is the amount you'll pay out-of-pocket before your auto insurance starts to cover damage.

- Endorsements: These modify your policy, providing additional coverage or altering the terms of your insurance.

- Claim process: Understand the steps to file a claim and what's involved in the process.

Choosing the Right Policy

Browsing through the myriad of insurance options can be challenging, but keeping in mind specific usage, value, potential risks, deductible amounts, and specialized providers can guide you toward selecting the right policy for your dump trailer. If your trailer is primarily used for business, make sure the policy covers commercial usage, as it can greatly differ from personal use coverage.

Consider the potential financial impact in the event of an accident or loss. This includes evaluating the value of the trailer and the possibility of having to pay for another. Choosing one of the best coverage limits can protect you from substantial out-of-pocket expenses.

| Consideration | Action |

|---|---|

| Specific Usage | Confirm the policy covers the dump trailer's actual use |

| Value & Potential Risks | Choose a coverage limit that aligns with the trailer's value and potential risks |

| Deductible Amounts | Review how they affect out-of-pocket expenses |

| Specialized Providers | Seek those who offer tailored protection for dump trailers |

Moreover, verify if the policy includes coverage for theft, vandalism, or non-collision incidents. Focusing on these key areas will help secure the right insurance for your dump trailer.

Frequently Asked Questions

Do I Need Insurance on My Travel Trailer?

"Yes, they need insurance on their travel trailer. Coverage necessity, trailer type, premium factors, policy limitations, and insurance benefits are key considerations. It's essential for protecting their investment and ensuring peace of mind."

What Is Trailer Interchange Coverage?

"Trailer interchange coverage protects one's investment during trailer exchanges. It covers physical damage, mitigates interchange risks, and offers benefits despite policy limitations. It's offered by numerous insurance providers, each with a specific claim process."

Are Owned Trailers Being Towed by an Insured Auto Are Automatically Covered For?

'Owned trailers towed by insured autos aren't automatically covered. Coverage depends on trailer valuation, trailer depreciation, liability coverage, collision insurance, and all-encompassing protection. It's crucial to verify these with the insurance agent.'

Do I Need to Insure My Trailer in Pa?

"While Pennsylvania regulations don't require it, insuring one's trailer is recommended. Insurance benefits include covering damage liabilities and theft protection, fulfilling any loan requirements. Despite no legal mandate, it's a smart protection measure."

Conclusion

Securing suitable dump trailer insurance safeguards your investment greatly. By understanding unique risks, unraveling insurance terminologies, and choosing all-inclusive coverage, you're poised to protect your property prudently. Consult credible insurance counselors to customize your coverage perfectly.

In this way, you prevent potential pitfalls and preserve your peace of mind. Always aim for an assured, advantageous insurance agreement for your valued vehicle.

Somebody essentially lend a hand to make significantly articles Id state That is the very first time I frequented your website page and up to now I surprised with the research you made to make this actual submit amazing Wonderful task

Your teamwork reflects the best of B2B collaboration strategies – truly commendable.

✔️꽁머니❂【꽁타 ggongta.com✔️】 [축구] 3월09일 23:30 분데스리가 묀헨글라트바흐 vs 쾰른 +0

꽁머니 받아서 삼만원으로 삼백만원 만들자 무료지급 무료머니✔️꽁머니❂【꽁타 ggongta.com✔️】